AGI Calculator 2026 or Adjusted Gross Income Calculator is an online tool to help you calculate your AGI from your Gross income and all the deductions. Calculating AGI can help you in determining the taxable income and the tax brackets. The Internal Revenue Service (IRS) uses your AGI to compute your taxable income and determine the tax credits and benefits you’re eligible to claim.

AGI also helps you determine your modified adjusted gross income (MAGI)

This calculator can help you understand what AGI is, how to calculate it, and how it affects your taxable income and tax bracket.

What is adjusted gross income?

Adjusted Gross Income is a term used in the United States to describe an individual’s total gross income for the year, minus specific deductions. AGI calculates an individual’s taxable income, which is the amount of income subject to federal income tax.

Adjusted Gross Income Formula: Gross income – Standard deduction (or itemized deductions)

To arrive at your AGI, you start with your total gross income, which includes wages, salaries, tips, interest, dividends, rental income, and other sources of income. You then subtract certain allowable deductions, such as contributions to a traditional IRA, certain medical expenses, and student loan interest payments.

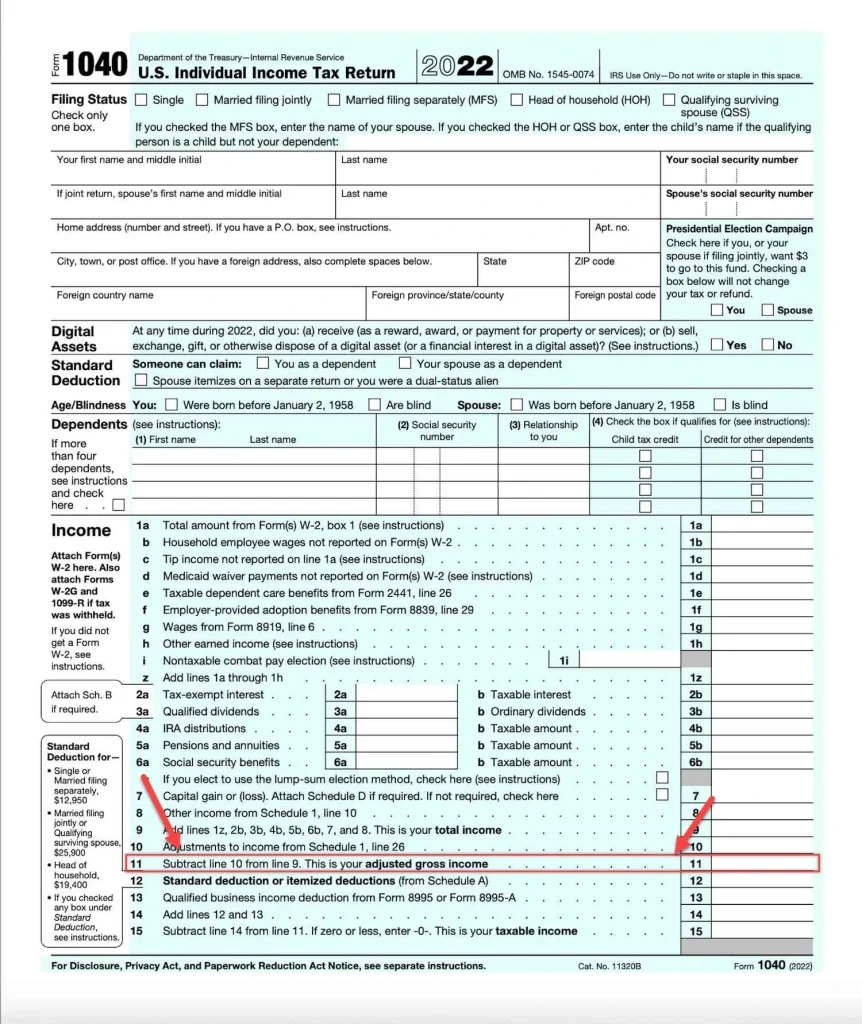

The resulting amount is your AGI, which is used to determine eligibility for certain tax credits and deductions, as well as the tax bracket in which you fall. AGI is reported on your federal income tax return, specifically on line 11 of Form 1040.

What is the most important number on your Tax Return?

The most important number on your Tax Return is adjusted gross income which you can find on the 11th line of the 1040 form.

Gross Income

Gross income refers to the total amount of income earned by an individual or entity before any deductions or taxes are taken out. It is the total amount of income received from all sources, including wages, salaries, tips, interest, dividends, rental income, and other sources of income.

Gross income is different from net income, which is the amount of income left over after deductions and taxes are taken out. Net income is what an individual or entity actually takes home or earns after all expenses and taxes have been paid.

It’s important to note that gross income is not the same as taxable income.

Taxable income is the amount of income that is subject to federal income tax after certain deductions and exemptions are applied.

The adjusted gross income is used to calculate taxable income.

Things that come under Gross income are

- Salary, wages, and tips

- Business/self-employment

- Interest, dividends, royalties, etc.

- Capital gains and losses

- Pension / Annuity / IRA distributions

- Other income

AGI deductions

Here is a list of common deductions that can be taken to reduce Adjusted Gross Income in the United States:

- Traditional IRA contributions

- Self-employed health insurance deductions

- Health Savings Account (HSA) contributions

- Student loan interest

- Alimony paid

- Educator expenses

- Moving expenses for certain jobs

- Contributions to a Health Flexible Spending Account (FSA)

- Half of the self-employment tax paid

- The deductible portion of self-employment retirement plan contributions

- Penalties on early withdrawal of savings

- Qualified tuition and related expenses

- Certain business expenses, including travel and entertainment expenses

- Rental and royalty expenses

- Losses from the sale or exchange of property

Please note that the specific rules for each deduction can vary, and not all deductions may be available to all taxpayers. It’s always best to consult with a tax professional to determine which deductions you are eligible for and to ensure that you are taking advantage of all the deductions and credits available.

Real-life AGI Calculation Example (Step by Step)

Here is an example of adjusted gross income for Maria, who earns $100,000 per year:

Step 1: Calculate gross income

Maria’s gross income is $100,000. This is the total amount of money she earned from all sources during the year, including her salary, wages, tips, and other forms of income.

Step 2: Calculate deductions

There are two types of deductions: the standard deduction and itemized deductions.

The standard deduction is a set amount you can deduct from your gross income, regardless of your actual expenses. The standard deduction for 2026 is $12,950 for single filers.

You can take itemized deductions for specific expenses, such as mortgage interest, state and local taxes, charitable contributions, and medical expenses. If your itemized deductions exceed the standard deduction, you can deduct the excess amount from your gross income.

Maria’s itemized deductions are as follows:

- Mortgage interest: $10,000

- State and local taxes: $5,000

- Charitable contributions: $2,000

- Medical expenses: $1,000

- Casualty losses: $500

Maria’s total itemized deductions are $22,500. This exceeds the standard deduction for 2026, so she can deduct the full amount from her gross income.

Step 3: Calculate adjusted gross income

AGI is calculated by subtracting your deductions from your gross income. Maria’s AGI is calculated as follows:

Gross income - Standard deduction (or itemized deductions) = Adjusted gross income

$100,000 - $12,950 = $87,050

Step 4: Calculate taxable income

Taxable income is calculated by subtracting your deductions from your AGI and applying for any applicable tax credits. Maria’s taxable income is calculated as follows:

Adjusted gross income - Deductions - Tax credits = Taxable income

$87,050 - $22,500 - $0 = $64,550In this example, Maria’s AGI is $87,050 and her taxable income is $64,550. This means that she will pay taxes on $64,550 of her income.

Uses of AGI

Adjusted Gross Income has several uses, including:

- Calculating taxable income: AGI is used to calculate your taxable income, which is the amount of income you are required to pay taxes on. Your taxable income is calculated by subtracting your allowable deductions from your AGI.

- Determining eligibility for certain tax credits and deductions: Your AGI is used to determine whether you are eligible for certain tax credits and deductions, such as the Earned Income Tax Credit, the Child Tax Credit, and the deduction for IRA contributions.

- Qualifying for certain tax benefits: Some tax benefits, such as the ability to contribute to a Roth IRA or claim certain education tax credits, have income limits based on your AGI.

- Applying for financial aid: Your AGI is used to determine your eligibility for financial aid when applying for college. The lower your AGI, the more financial aid you may be eligible to receive.

- Obtaining a mortgage: When applying for a mortgage, your AGI may be used by lenders to determine your ability to repay the loan. A higher AGI may improve your chances of being approved for a mortgage.

Overall, AGI is an important figure that is used to determine your tax liability, eligibility for certain tax benefits and credits, and financial aid for education. It is important to accurately calculate your AGI when filing your tax return or applying for financial assistance.

How to calculate AGI

AGI is calculated by starting with your total gross income from all sources, then making certain allowable deductions to arrive at your AGI. Here are the steps to calculate your AGI:

- Start with your total gross income: This includes all income you received during the tax year, such as wages, salaries, tips, interest, dividends, rental income, and other sources of income.

- Subtract above-the-line deductions: These are deductions that can be taken before you itemize your deductions, such as contributions to a traditional IRA, certain student loan interest payments, and certain self-employed business expenses.

- Subtract the standard deduction or itemized deductions: You can choose to take either the standard deduction or itemize your deductions, whichever is greater. The standard deduction is a set amount that varies depending on your filing status. Itemized deductions include expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses that exceed a certain threshold.

- Subtract any personal exemptions: Personal exemptions are deductions you can take for yourself, your spouse, and your dependents.

The resulting amount is your AGI, which is used to determine your taxable income and your eligibility for certain tax credits and deductions. It’s important to accurately calculate your AGI, as errors can result in underpayment or overpayment of taxes.

Also Check: AGI vs Taxable Income