Introduction: Understanding the Role of W-2 and AGI

When it comes to filing your taxes, understanding key terms and concepts is crucial. One such term is Adjusted Gross Income (AGI).

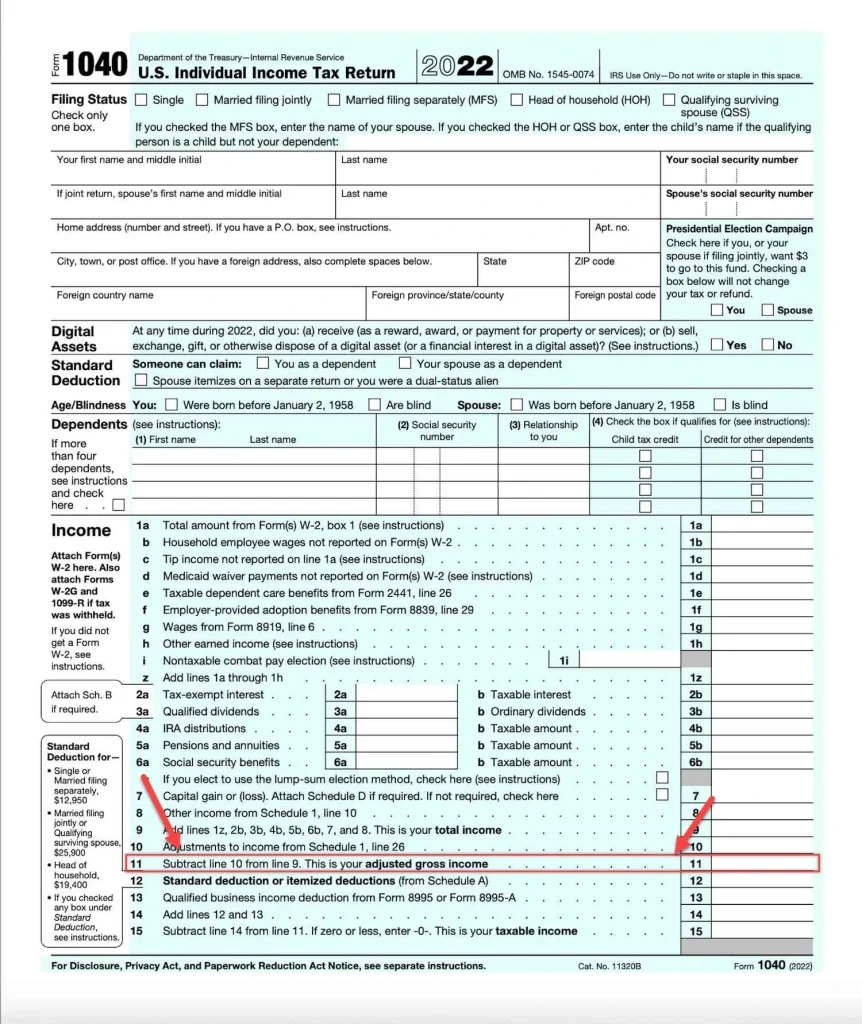

AGI serves as an essential component in calculating your taxable income and determining your eligibility for various deductions and credits. While your W-2 form provides valuable information about your earnings and taxes withheld, it does not directly report your AGI.

In this article, we will explore where you can find your AGI and the steps involved in calculating it accurately.

Where can you find your AGI from the previous year’s tax return?

AGI is on line no 11 of the 2026 tax return on Form 1040, 1040-SR, and 1040-NR

AGI location varies depending on the tax year and form 1040 versions

| Tax Year/Form | Location on the Form |

|---|---|

| 2021 – Form 1040/1040-SR | Line 11 |

| 2021 – Form 1040-NR | Line 11 |

| 2019 – Form 1040/1040-SR | Line 8b |

| 2018 – Form 1040 | Line 7 |

| Before 2018 – Form 1040A | Line 21 |

| Before 2018 – Form 1040EZ | Line 4 |

What is AGI (Adjusted Gross Income)?

AGI or Adjusted gross income is the taxable income that can be obtained by removing certain deductions from your total income. Know more about AGI Calculation in detail.

Why is AGI important when filing taxes?

AGI plays an important role in verifying your identity while tax filing. While e filing your income taxes IRS uses your previous year’s AGI to verify your identity. If the AGI you input this year does not match the AGI from your previous year’s return, the IRS will reject your tax return

What should you do if you’re having trouble finding your AGI?

if you had trouble finding your AGI, request the Tax transcript from IRS, your AGI will be in the Adjustment to Income section